33+ mortgage interest tax deductions

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now.

Mortgage Interest Deduction How It Calculate Tax Savings

It reduces your taxable income so you dont owe as much.

. Even though two unmarried individuals can both be the legal owners of the home and pay the mortgage equally or from common funds the lender. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. As a result Im only getting the Standard Deduction.

In the year you. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. 12950 Heads of households.

If the additional 12k of Mortgage. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. For taxpayers who use married filing separate status the.

For tax years before 2018 the interest paid on. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. The IRS places several limits on the amount of interest that you can deduct each year.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. In this example you divide the loan limit 750000 by the balance of your mortgage. Taxes Can Be Complex.

To deduct taxes or interest on Schedule A Form 1040 Itemized Deductions you generally must be legally obligated to pay the expense and must have paid the expense during the year. Web Deduction of Medically Necessary Home Improvements. So if you were dutifully.

Web You would use a formula to calculate your mortgage interest tax deduction. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. 19400 If your total.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. However higher limitations 1 million 500000 if married. Learn More at AARP.

HELOCs are no longer eligible for the. Web This deduction filed with IRS Form 1098 can add up to thousands of dollars for most homeowners. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Web Your income exceeds 1100 and includes more than 350 of unearned income such as interest or dividends. But for loans taken out from. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Web Mortgage interest. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. This deduction is capped at 10000 Zimmelman says.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Is mortgage interest tax deductible. 12950 Married filing jointly.

Web Enter your address and answer a few questions to get started. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. Web Mortgage Interest inside of TT does not seem to be computing correctly. You may qualify for a medical expense deduction if you install special equipment in or make modifications to.

Taxes Can Be Complex. Web My Mortgage Interest 12k is not being included on Schedule A. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs.

Web Basic income information including amounts of your income. Web Answer a few questions to get started. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Keep in mind that this exemption only applies to. Web You can claim a tax deduction for the interest on the first 750000 of your mortgage 375000 if married filing separately.

Web Mortgage balance limitations. 25900 Married filing separately. Web The standard deductions for 2022 follow.

We have one home with mortgage interest points and no other loan costs. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Cash Out Refinancing What Is It Rates Pros And Cons Vs Home Equity Loan 2021 Cain Mortgage Team

Mortgage Interest Deduction Bankrate

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Will The New Tax Law Affect My Mortgage Interest Deduction San Diego Mortgage Broker San Diego Home Loans

12 Business Expenses Worksheet In Pdf Doc

Betterment Resources Original Content By Financial Experts

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Betterment Resources Original Content By Financial Experts App

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Is The Interest On Your Mortgage Tax Deductible In Canada Loans Canada

33 Stub Templates In Pdf

American Economic Association

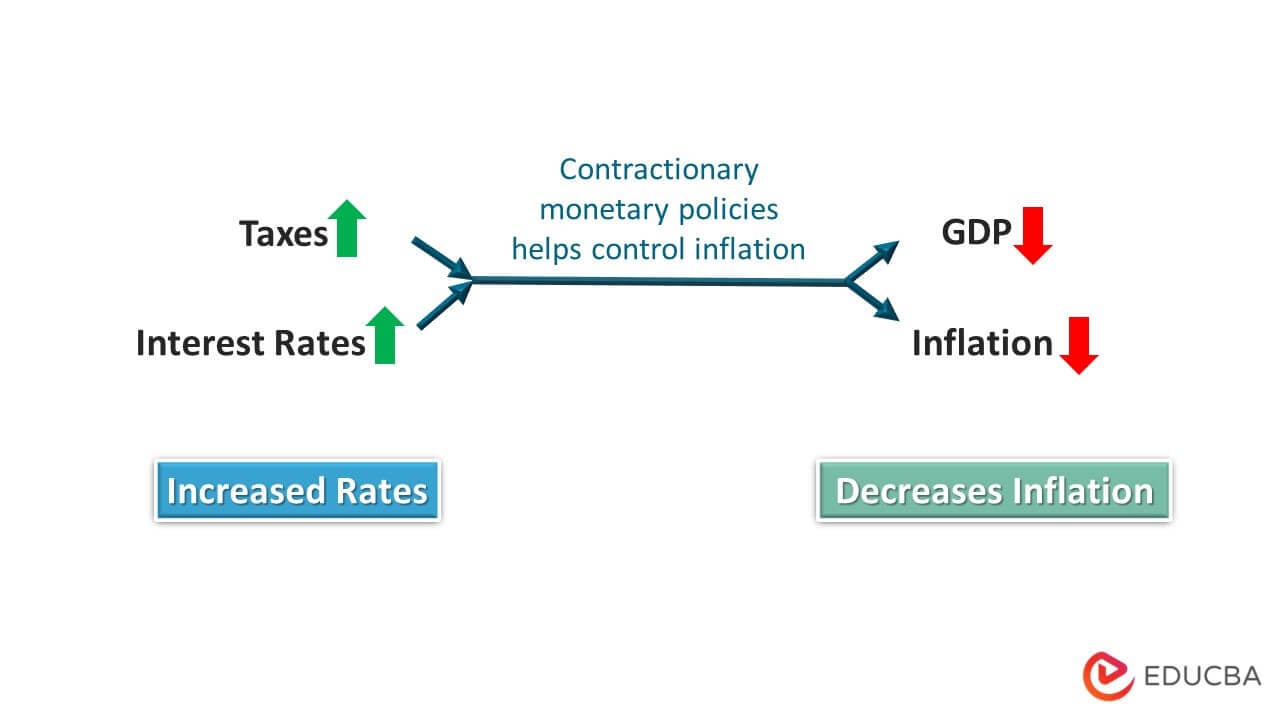

How Does Contractionary Monetary Policy Work Meaning Examples