29+ conventional mortgage vs fha

Compare Offers Side by Side with LendingTree. Get Started On Your Application Online And Be On Your Way.

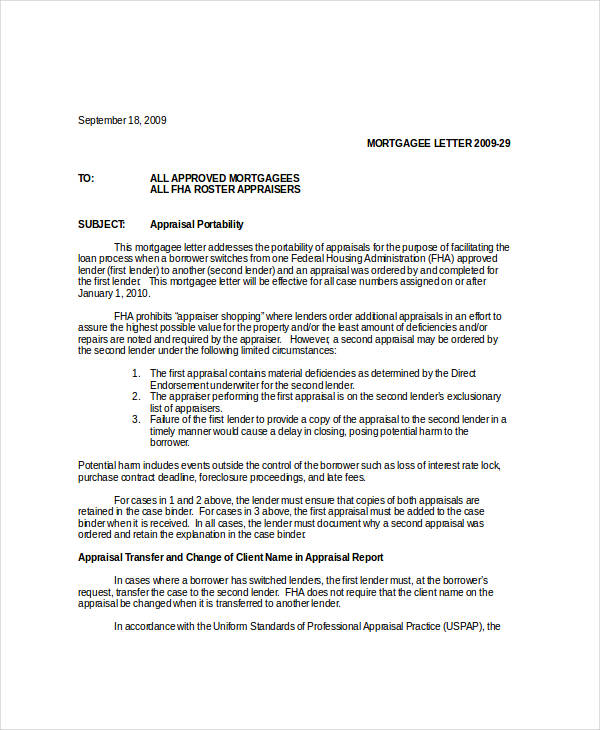

Appraisal Transfer Letter Template 5 Free Word Pdf Format Download

Web FHA requirements are more lenient than those for a conventional loan.

. Our video compares the pros and cons of both options to h. Web With FHA loans buyers may be able to put as little as 35 down. Ad Refinance Your House Today.

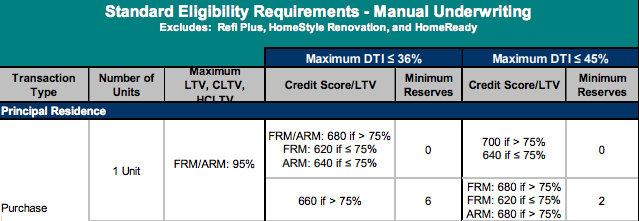

GameStop Moderna Pfizer Johnson Johnson AstraZeneca Walgreens Best Buy. Web Conventional loans require a minimum credit score of 580 while FHA loans have a lower base limit of 500. Web Indeed FHA loans typically require credit scores of 580 and above while the minimum for a conventional loan is 620 with many lenders requiring higher scores.

Conventional mortgages to consider is FHA County loan limits. Web 3 subscribers in the mortgageonlinelender community. Web Looking to buy a home but not sure whether an FHA loan or a conventional mortgage is right for you.

Web Factor FHA loan Conventional loan Credit score requirements 580 with a 35 down payment 500 with a 10 down payment 620-720 depending on the situation. Youll need a fair. Better offers both loan types with the same minimum.

Refinance Your FHA Loan Today With Quicken Loans. Ad Get The Right FHA Mortgage Rate For You By Comparing Standout Lenders Today. Web Conventional loan.

Ad Compare Your Best Mortgage Loans View Rates. Business Economics and Finance. Ad Refinance Your House Today.

Web Conventional loans typically require at least a 5 down payment. Get Home Faster With MT. Calculate Your Monthly Payment Now.

However some lenders now offer. Its Never Been Easier. Web Because FHA loans are insured by a government agency requirements are often less strict than for a conventional mortgage.

Well Talk You Through Your Options. Well Talk You Through Your Options. Get the Right Housing Loan for Your Needs.

Web Federal Housing Administration FHA loans help you clear some of the hurdles along the way to buying a home with more relaxed qualifications than other loans. Calculate Your Monthly Payment Now. Most lenders will require a back-end DTI your potential mortgage payment plus all your other debt payments compared to monthly income of.

Discover The Answers You Need Here. Refinance Your FHA Loan Today With Quicken Loans. Web Another difference between FHA vs.

Find A Great Lender Today. Web An FHA loan may require a down payment as small as 35 compared to the traditional 20 thats recommended for conventional loans. Ad Select Your Perfect Loan And Get Started Today.

In 2022 the baseline limit of an FHA loan for a single-family home increased by 65000. The calculations below are based on your chosen percentage for the FHA loan down. Depending on the county the property is located the maximum.

Web Thanks to more lenient credit requirements and a low down payment FHA loans are a common loan option for first-time home buyers. Have a credit score of at least 500 Make a 35 to. You can qualify for an FHA loan if you.

Web Both conventional and FHA loans have limits that are adjusted every year. Conventional loans used to require a minimum down payment of 20. Theyre also suitable for.

Our Team Statewide Mortgage

Fha Loan Vs Conventional Mortgage Which Is Right For You Supermoney

At A Glance Strong Home Mortgage Llc

Non Conforming Loan Complete Guide On Non Conforming Loan

Fha Loan Vs Conventional Mortgage Which Is Right For You Supermoney

Scott Brown Founder Mortgage Advisor Spectrum Mortgage Solutions Llc Linkedin

Fha Vs Conventional Loans What S Better For You Total Mortgage

Staci Robinson Senior Mortgage Sales Associate Valley Bank Linkedin

Fha Vs Conventional Loan What S The Difference

Conventional Loan Vs Fha Loan 2023 Rates And Guidelines

Fha Vs Conventional Loan Comparison Chart Fha Lenders

![]()

Fha Loan Vs Conventional Mortgage Which Is Better

What S The Difference Between Fha And Conventional Home Loans

845 Williams Rd Defuniak Springs Fl 32433 Zillow

Fha Vs Conventional Loans What S Better For You Total Mortgage

What Is Fannie Mae Purpose Eligibility Limits Programs

Fha Vs Conventional Loan Nerdwallet